Contracts for Difference (CFDs) have emerged as a popular trading instrument in recent years, offering traders a unique way to participate in financial markets. CFD trading allow individuals to speculate on the price movements of various assets, including stocks, indices, commodities, and currencies, without owning the underlying asset itself.

One of the key advantages of CFD trading is the flexibility it provides. Traders can take both long and short positions, enabling them to potentially profit from rising and falling markets. Additionally, CFDs offer flexible leverage options, allowing traders to control larger positions with a smaller initial investment. However, it’s crucial to understand that leverage can amplify both potential gains and losses.

Another appealing aspect of CFDs is the wide range of markets accessible through a single trading account. CFD brokers often provide access to global markets, allowing traders to diversify their portfolios and seize opportunities across different asset classes and geographies.

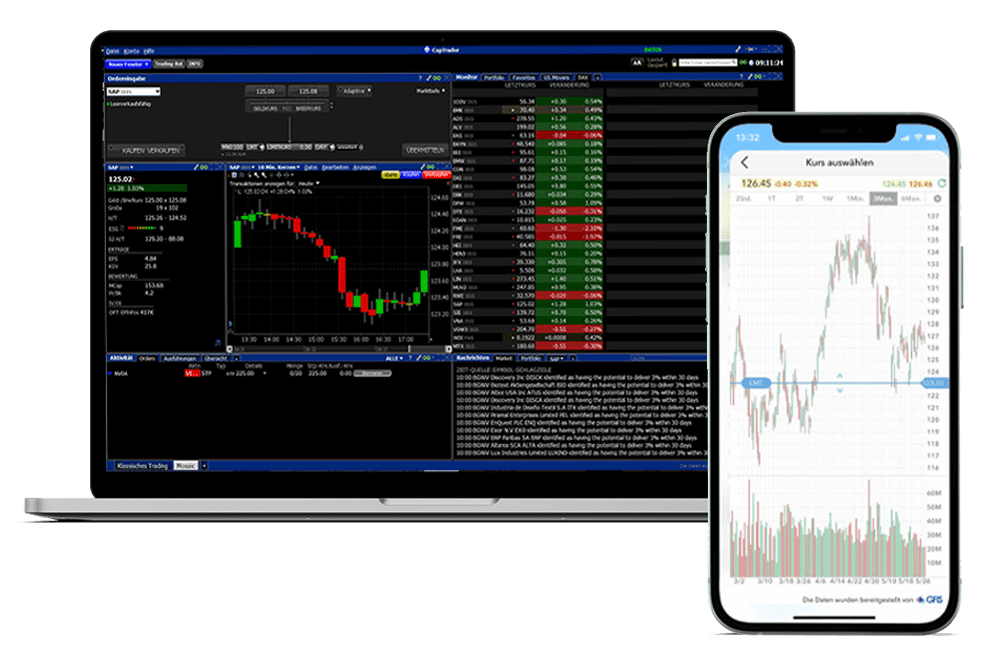

When considering CFD trading, it’s essential to choose a reputable broker that offers a user-friendly trading platform, competitive pricing, and robust educational resources. Look for brokers that provide demo accounts, allowing you to practice trading strategies and familiarize yourself with the platform before committing real funds.

As with any form of trading, it’s crucial to educate yourself thoroughly about the risks involved. CFDs are complex instruments that require a solid understanding of market dynamics, risk management, and trading strategies. Ensure you have a well-defined trading plan, set appropriate stop-loss orders, and never risk more than you can afford to lose.

In conclusion, CFDs offer an exciting new frontier in trading, providing flexibility, market access, and potential opportunities for diversification. However, it’s essential to approach CFD trading with caution, education, and a well-thought-out strategy. By doing so, traders can navigate this dynamic market and potentially reap the rewards of successful CFD trading.